[ad_1]

Why do we discuss and consider economic incentives associated with CO2 pricing?

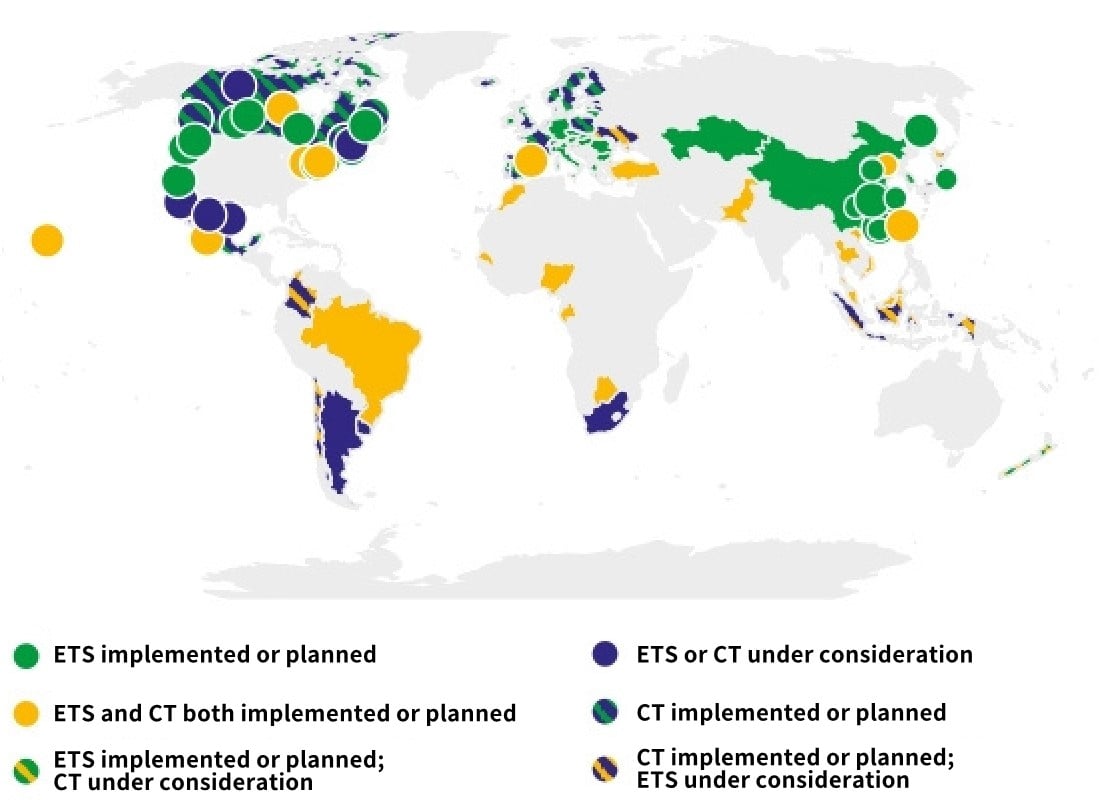

Carbon pricing was limited to only a part of Europe as of 2000, but it has now expanded across the world. A total of 70 CT and ETS schemes have been implemented. Image credit: University of Tokyo

Making carbon pricing more visible is vital

The concentration of CO2 in the Earth’s atmosphere has continued to increase to ever higher levels since the start of the Industrial Revolution in the mid-19th century. In those days, no one would have even imagined that steam engines could be linked to global warming.

In economics, phenomena that, if left unchecked, cause market mechanisms to fail are called externalities. CO2 emissions are considered a negative externality because they harm the Earth’s environment. If we ignore such phenomena, the amount of CO2 emitted during economic activity would be higher than that deemed socially acceptable.

One of the tools used to include such externalities in market mechanisms is carbon pricing (CP). Two of the most well-known types of CP are carbon taxes (CT) and emission trading schemes (ETS).

Japan has introduced both of these – CT in the form of the Tax for Climate Change Mitigation, and ETS as initiatives that have already been implemented in Tokyo and Saitama Prefecture. Additional measures will need to be introduced, however, as it has been pointed out that carbon neutrality (CN) by 2050 cannot be achieved just by extending the current schemes.

In its narrow sense, CP refers to taxes levied in proportion to the amount of carbon emitted. Going by this definition, Japan’s CP is slightly less than 300 yen/tCO2, which generates only a low CT.

However, even if not strictly going by the amount of carbon emitted, Japan has contributed to CO2 reduction through a number of measures that are not necessarily directly intended for that purpose, such as the Energy Conservation Act, the Act on Sophisticated Methods of Energy Supply Structures and the taxation of gasoline.

That is why every additional ton of CO2 reduction costs more to achieve in Japan than anywhere else — recent calculations indicated 452 US dollars per ton, around 10 times the global average.

In a wider sense, CP can also be described as “implicit.” Most of the relevant regulations in Japan are either quantitative in nature or establish requirements for facilities, and are not necessarily expressed in terms of price.

Thus, it is difficult to standardize and convey the current situation in CP terms. By making this implicit CP more explicit, Japan needs to increase the transparency of its CP and explain it to the rest of the world. And, by converting international discussions on production-based CO2 emissions to those based on consumption, we should ensure that serious discussions on sustainable countermeasures for global warming are driven by consumers.

Source: University of Tokyo

[ad_2]

Source link